The Tesla Model 3 is about to hit Europe. And that could be a big deal for European car manufacturers.

Here’s today’s starter for ten: in which country are electric cars (EVs) currently outselling the equivalent petrol and diesel models?

Is it eco-friendly Norway? The bicycle-embracing Netherlands? Nope — it’s the good old gas guzzlin’ USA.

Furthermore, it’s all down to one company.

Tesla.

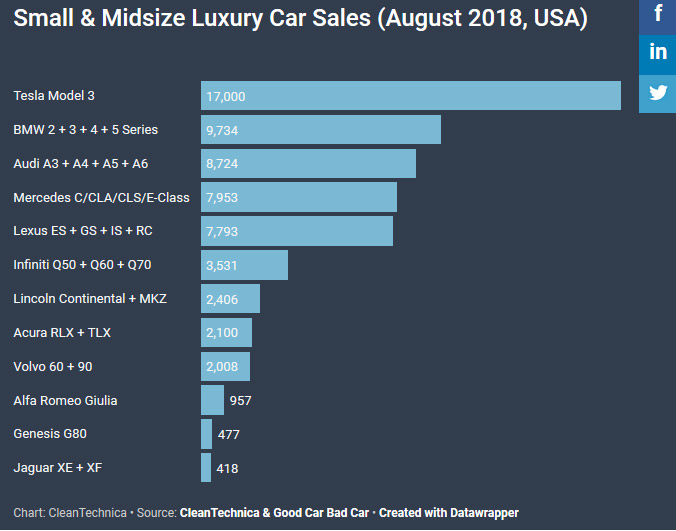

As the California-based EV company has overcome its production problems, sales have gone through the roof — at the expense of rival European and Japanese companies. A few comparisons should make the point. Take a look at the August sales figures from cleantechnica.com (their estimates usually aren’t too far out):

We think that’s pretty staggering. A relatively new manufacturer has sold almost as many small luxury cars as Audi and BMW put together. And they’re electric cars.

It doesn’t stop there, either. If we look at total US car sales (not counting pick-up trucks, SUVs etc), Tesla is storming up the charts. In August, the Tesla Model 3 was the fifth most popular model in the USA, behind two Hondas and two Toyotas.

A flash in the pan? Maybe, but bear in mind that these sales have been achieved entirely through orders of the expensive, top-spec Model 3. When Tesla finally gets around to selling its $35,000 version, sales could well leap forward again.

Tesla’s fans are clear about how the company has achieved this coup: it’s offering a superior product. The Model 3 is fast, almost silent, cheap to run, environmentally friendly, sleek, and loaded with cool technology and driver aids. Even Top Gear, not the traditional habitat of the EV lover, calls it “a triumph“.

All of which leads us to the big question…

Could Tesla take over Europe?

Or to phrase the question less dramatically, how much of a threat could Tesla be to the European car giants? If Americans are abandoning their German luxury cars by the thousand, could the same happen over here?

According to CEO Elon Musk, the first Tesla Model 3s should arrive in Europe towards the middle of next year. Some commentators are arguing that the big European manufacturers are simply not ready for a market-disrupting invasion.

In one thought-provoking article, German engineer Alex Voigt comments:

It is time to face the uncomfortable truth that the German automakers do not have a single car, be it a gas/diesel car or an electric car, in production or in development today that can compete with the Model 3.

If they had such a car, we would have seen it already, either in production or as a concept version. The lost market share, revenue, and profit that Daimler, BMW, Audi, VW, and Porsche are facing in the US today is an unprecedented humiliation of premium car innovation and production in Germany. We have no reason to believe that what happened in the US already will not happen in Europe and Asia on the same scale in the near future.

Voight points out that although Tesla’s 2017 sales are still relatively small (about 1% of the Volkswagen Group’s, for example), the shift to electric vehicles is happening right now and it’s happening at incredible speed. We know that in VW’s case, they have extensive plans for electrification, but are they too late to the party? EV sales in Europe are a massive 40% higher in 2018 than last year, and analysts anticipate there will be 1.35 million electric or part-electric cars on the road by the end of the year.

In our view, this demand will be greatly accelerated as Europe ramps up the restrictions on diesel vehicles. Older diesels face punitive charges or outright bans in city centres across Europe, and this may be a crucial factor for drivers deciding on their next vehicle.

With its ground-breaking Model 3, Tesla seems poised to take advantage of burgeoning EV sales. If their European competitors don’t get a move on, they could be left behind.

Halting the invasion

However, this view ignores one important factor: vehicle type. The Model 3 is a saloon car (sedan if you’re in the US), and the market for saloons has been declining for years. The US is in love with the pick-up truck and — to a lesser extent — larger SUVs. In Europe too, sales of saloons are dwarfed by the twin big-hitters: hatchbacks and small SUVs. Are Tesla all set to dominate a market that’s dying on its feet?

Not necessarily. One thing that Tesla has demonstrated is that it’s an agile, hungry manufacturer. This is the company that’s both brought groundbreaking cars to market and increased its sales by over 25,000% in six years. And the fact Tesla move so fast could present a challenge for the Euro giants. Because if Tesla decide to build a small SUV or family hatchback, some believe that they could do it whilst VW or BMW are still at the maybe-we-should-get-around-to-it-soonish stage.

After all, it’s hard to imagine BMW or VW building cars in tents to meet their production targets. With billions in the bank, and decades of dominating the competition, they’re just not that desperate.

And maybe that’s the problem.

The WVS blog covers a wide range of automotive topics, from the contentious to the light-hearted. We are an independent garage specialising in all the VW group marques, including Audi, Volkswagen, Skoda and SEAT. WVS provides services, repairs and MOTs, delivering a main dealer level of care at affordable prices. To book your vehicle in, or for any enquiries, get in touch.

Thanks to cleantechnica.com for the use of their charts and quote.